https://5705202.fs1.hubspotusercontent-eu1.net/hubfs/5705202/startup-business-woman-working-with-business-documents.jpg

https://5705202.fs1.hubspotusercontent-eu1.net/hubfs/5705202/startup-business-woman-working-with-business-documents.jpg

Stephan Zigler

Marketing Manager

February 18, 2026

Hotel trends

Fact Check Winter 2025/2026

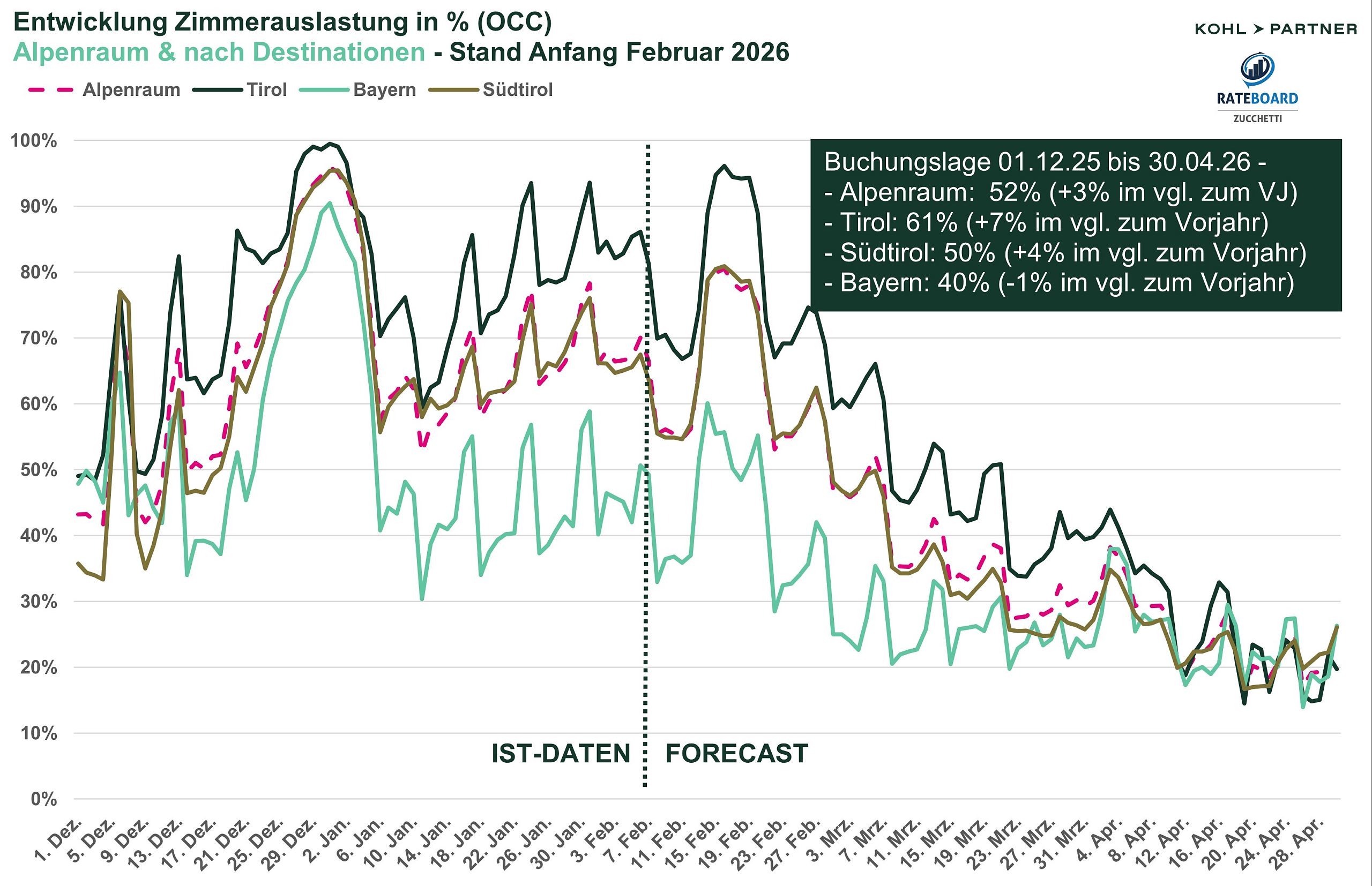

Interim results in the Alpine region – stable demand, prices higher than last year, and growing regional differences

Season progress under improved conditions:

With December and January now behind us, we have a reliable initial interim assessment of the 2025/26 winter season. After a somewhat mild start to the season in December, snowfall in January led to a noticeable stabilization in demand in many Alpine destinations. The actual figures for December and January, as well as the current forecast for February to April, paint a cautiously positive picture for the rest of the season.

The analysis is based on a joint fact check by Kohl > Partner and RateBoard.

Demand trends in the Alpine region: Tyrol and South Tyrol above previous year – Bavaria with subdued development

The Alpine region is currently slightly above the comparable level of the previous year. Average occupancy rose from 49% to 52%. This confirms a solid overall demand base for the 2025/26 winter season. The months of December and January, which have already been completed, contributed significantly to this development, while the forecast figures for February and March signal further regionally differentiated demand potential.

There continue to be significant differences within the Alpine region:

Tyrol achieved the highest occupancy rate at 61% and also recorded the strongest growth compared to the previous year at +7%. The good start to the season and reliable snow conditions in January helped to support this. South Tyrol increased its occupancy rate to 50% (+4%), placing it in the middle of the Alpine region. Demand remained stable in the first two months, and the forecast for February indicates that this positive trend will continue. Bavaria remained largely at the previous year's level (–0.6%) with an occupancy rate of 40%. Despite selective improvements in January, demand is expected to be more subdued in the coming months in particular.

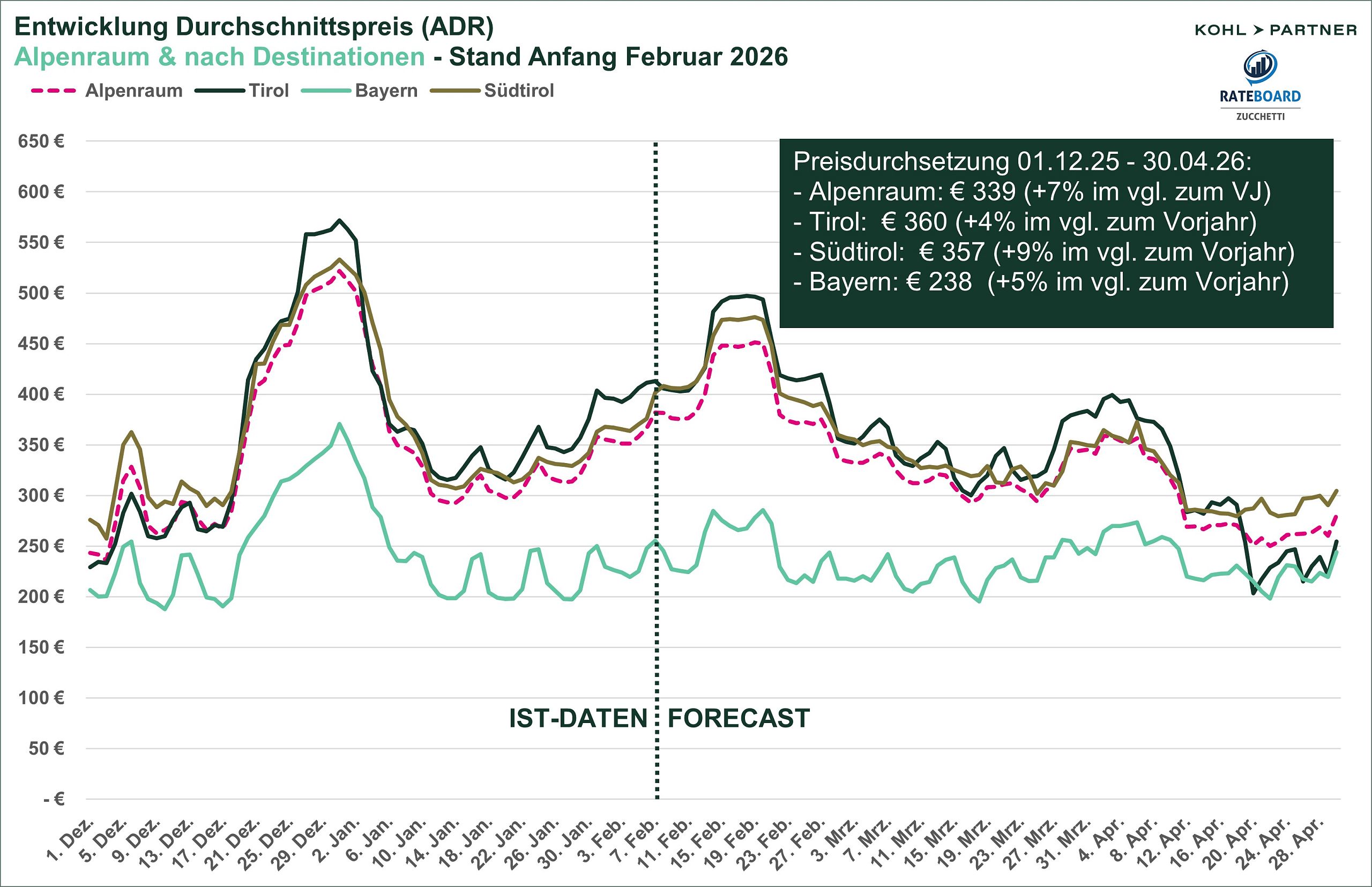

Price enforcement for the 2025/2026 winter season: South Tyrol and Tyrol with higher price levels, Bavaria significantly below

There has also been an overall increase in price enforcement in the Alpine region. The average room rate rose from €318 to €339 (+7%). This means that willingness to pay in the market remains fundamentally stable despite economic uncertainties.

Tyrol once again confirmed its position as price leader with an average ADR of €360 (+4%). In addition to its strong market position, price enforcement remained stable in the months under review, while the forecast for the remainder of the winter season points to moderate further growth.

South Tyrol achieved an average ADR of €357 (+8.5%), recording the strongest price increase in the comparison. The high season weeks in particular benefited from solid demand.

At €238, the ADR in Bavaria remains well below the Alpine level, but shows a steady price trend with an increase of 5.3% – albeit without a corresponding increase in demand.

Conclusion: Good start to the season, differentiated market environment

The interim results for the 2025/26 winter season show an overall stability in the market environment in the Alpine region. Demand and price enforcement are above last year's levels, while regional disparities continue to increase. While Tyrol and South Tyrol are consolidating their positions, Bavaria continues to lag significantly behind.

From the perspective of Thomas Steiner, Managing Partner at Kohl > Partner, the current interim results confirm an overall robust development, but also highlight the increasing differentiation in the market:

“The figures show that the winter of 2025/26 is developing more steadily than many had initially expected. At the same time, it is becoming clear that market opportunities and risks are diverging more sharply. In the coming weeks, it will be crucial for businesses to realistically assess actual demand, align their revenue and cost structures accordingly, and draw the right economic conclusions.”

Matthias Trenkwalder, CEO of RateBoard, adds to this by pointing out the operational perspective and the importance of differentiated price management as the season progresses:

“The current data shows that price enforcement is much more selective this winter season. This makes it all the more important to base pricing decisions closely on actual demand and current booking patterns.”

SHARE

Subscribe To Our Newsletter

Sign up now and receive monthly hotel and revenue management insights.