-1.jpg)

Alexandra

Junior Marketing Manager

November 30, 2022

RateBoard Insights

A current price study for the Austrian hotel industry

How have occupancy and turnover in Austrian hotels developed since the beginning of the pandemic and amidst the economic uncertainty compared to before? RateBoard's room price analysis shows: not bad! The establishments examined in the study offer a good indicator for the Austrian holiday hotel industry in the premium segment.

After tourism in Austria had to struggle with corona-related regulations in the past two years, it was possible for the first time since the beginning of 2022 to take place almost “as before” and with only very few restrictions. In the holiday hotel industry, the demand trend shows hardly any change compared to 2019. The main travel times are still the winter months from December to March and the summer months from mid-June to mid-September. There is no question that the numbers are different this year and will be described in the following article.

Summer as we know it?

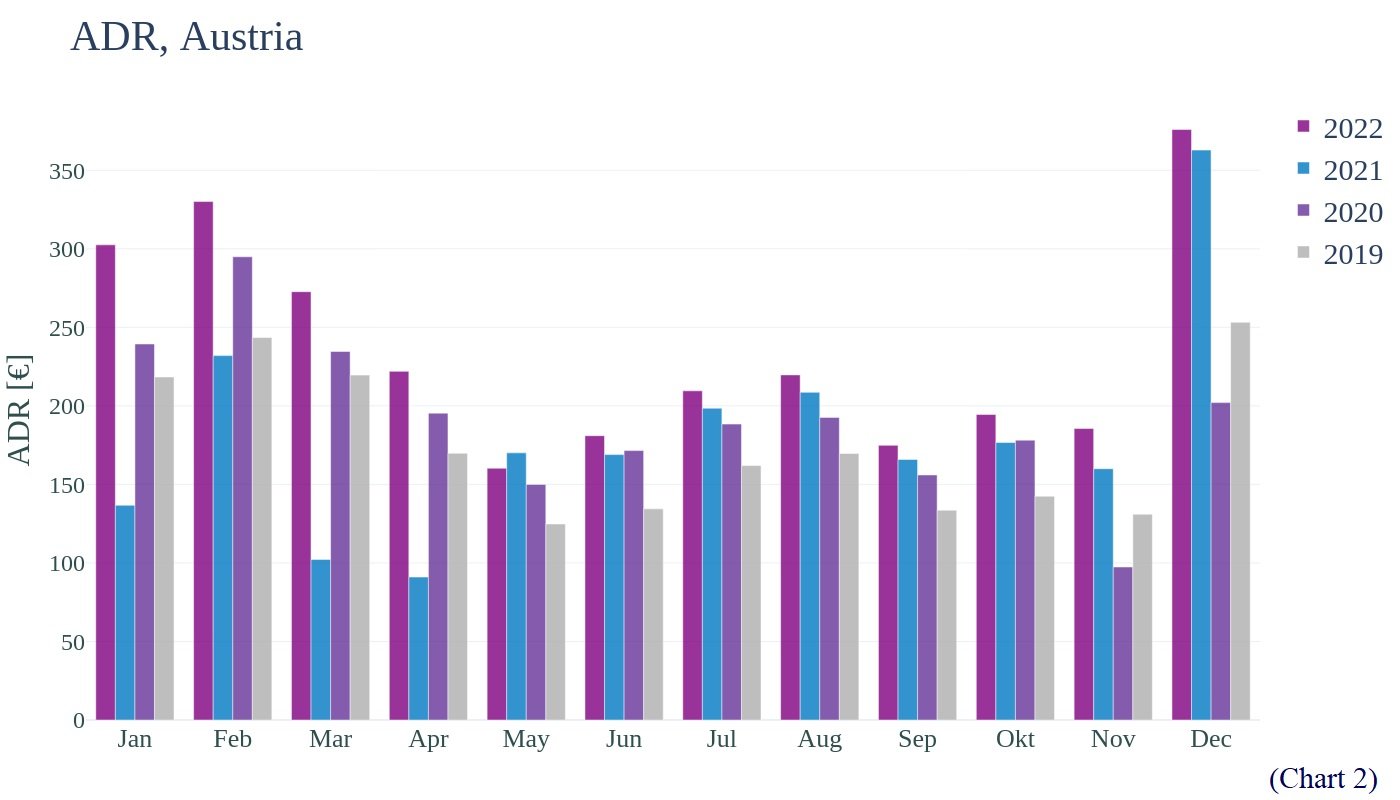

The summer of 2021 started slowly after the last lockdown in Austria and demand only began to increase sharply from June onwards..jpg?width=5600&height=3200&name=Grafik%20occ-AT-english%20(1).jpg) In the course of this year, demand has developed much more evenly, as illustrated in chart 1. The businesses examined achieved an average occupancy rate of 56% in the summer months from July to September, although it needs to be mentioned that the majority of these hotels have their peak season in winter, which is why the average value is lower than expected. It comes as no surprise that room prices increased in summer due to the current economic state with an inflation in the double digits and high energy costs. The average daily rate of the approximately 100 companies surveyed amounted to 203 euros per day and room, compared to 193 euros in the previous summer. Compared to the summer three years ago, when the average room rate was only at 156 euros, a price increase of 30 percent can be seen.

In the course of this year, demand has developed much more evenly, as illustrated in chart 1. The businesses examined achieved an average occupancy rate of 56% in the summer months from July to September, although it needs to be mentioned that the majority of these hotels have their peak season in winter, which is why the average value is lower than expected. It comes as no surprise that room prices increased in summer due to the current economic state with an inflation in the double digits and high energy costs. The average daily rate of the approximately 100 companies surveyed amounted to 203 euros per day and room, compared to 193 euros in the previous summer. Compared to the summer three years ago, when the average room rate was only at 156 euros, a price increase of 30 percent can be seen.

Almost no change in capacity utilization was registered over the past 3 summer seasons. From this it can be concluded that the significant increase in room prices has only a minor impact on demand. A natural explanation for this is the value of vacations in the population which has not yet been diminished by rising prices. The travel restrictions and COVID-19 measures have made travel more difficult or have stopped it altogether, while the need for recreation has increased. As a result, increased prices in summer were largely accepted by travelers. This behavior, along with new guest segments such as the Revenge Traveler, will be described in more detail in another RateBoard article.

Almost no change in capacity utilization was registered over the past 3 summer seasons. From this it can be concluded that the significant increase in room prices has only a minor impact on demand. A natural explanation for this is the value of vacations in the population which has not yet been diminished by rising prices. The travel restrictions and COVID-19 measures have made travel more difficult or have stopped it altogether, while the need for recreation has increased. As a result, increased prices in summer were largely accepted by travelers. This behavior, along with new guest segments such as the Revenge Traveler, will be described in more detail in another RateBoard article.

As it was

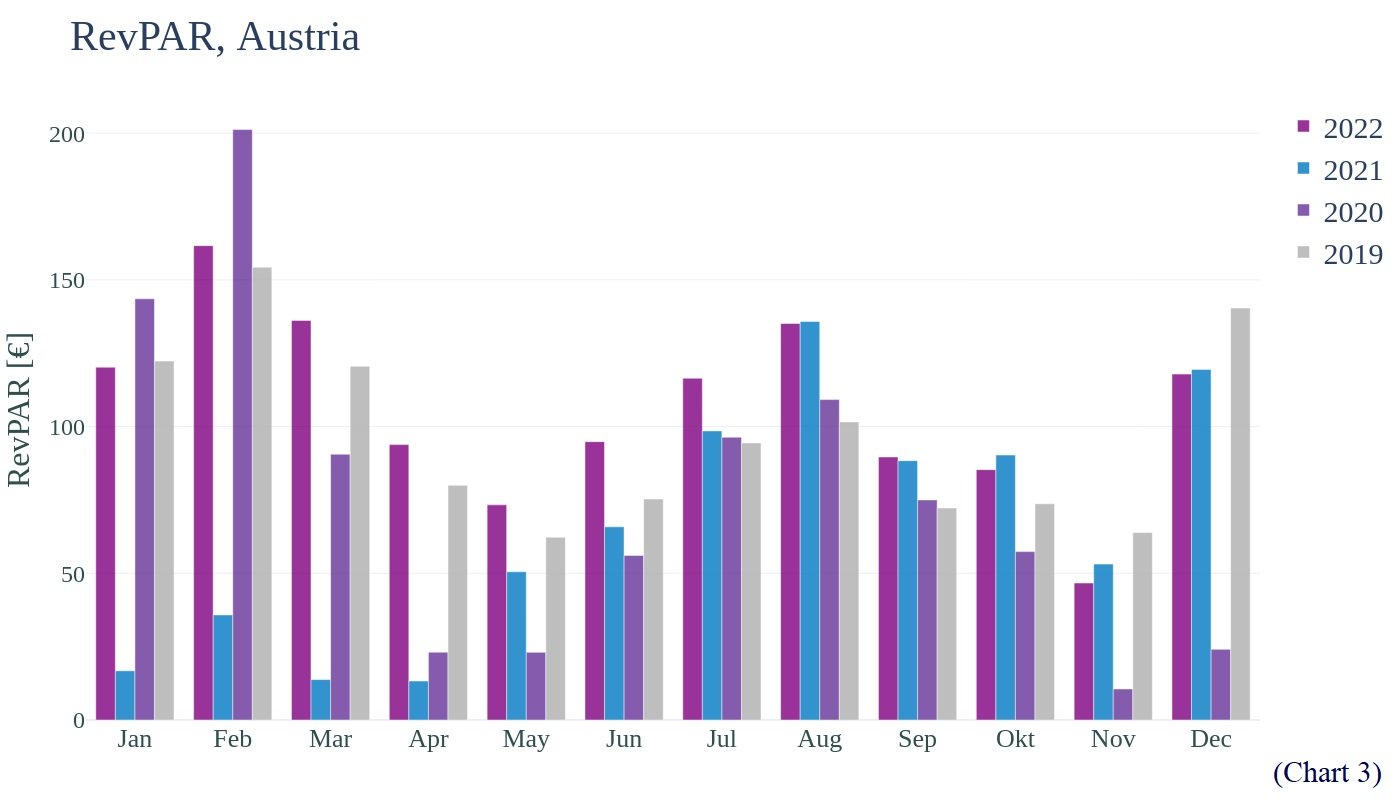

In Austria, the year 2022 started comparatively slow in terms of capacity utilization. The occupancy curve in the winter season of the companies analyzed by RateBoard is still well behind that of 2019, while in the summer months of 2022 it was only slightly weaker than 3 years ago. An equally notable aspect is the daily rate for a hotel room, which shows considerable differences especially in the first few months of the year compared to previous years. The influence of the room price increase on the total revenue is illustrated in chart number 3, the revenue per available room, also known as RevPAR.  To elucidate this, occupancy in February 2022 is a few percentage points lower than February 2019, the average daily rate was significantly higher, resulting in higher revenue per room and correspondingly higher total revenue.

To elucidate this, occupancy in February 2022 is a few percentage points lower than February 2019, the average daily rate was significantly higher, resulting in higher revenue per room and correspondingly higher total revenue.

Outlook winter 2022-23

Looking ahead to the coming winter, the hotels analyzed in October were up almost 90 percent on the occupancy curve of the previous year at the same time. This considerable difference is likely caused by the uncertainty of government restrictions to control Covid cases in the past winter season. When looking at the charts, it must be taken into account that the presented numbers for periods after October are not complete as they are still bookable, while the figures for previous seasons correspond to the final results. This means that the seasons can only be compared to a limited extent.

Last year, a quarter of all bookings were made by the end of October, which corresponds to 36 percent of the total days of stay and almost half of the RevPAR for the entire winter season. In comparison, the RevPAR for the coming winter season is already more than 80 percent above that of the previous year. The period considered as the winter season in this study refers exclusively to the months of December, January and February.

A comparison to the figures from before the start of the pandemic shows that by October 2019 almost two thirds of the total RevPAR for the 2019/2020 winter season had been reached and one third of all bookings had been made. As of October 2022, the occupancy rate for the coming winter season is 10 percentage points below that of 2019, but with an upward trend for the start of the season. It is due to the changed booking behavior, the increasing economic and geopolitical uncertainty as well as the high inflation that bookings for the winter are expected at shorter notice than in the summer.

Higher room rates bring more total revenue

It is gratifying that on close analysis the Austrian holiday hotel businesses examined as a whole had achieved good economic performance at the time of the analysis, despite difficult conditions. If you compare the average room prices for the entire year with last year, you can see an average price increase of 20 percent. A comparison to 2019 shows that room prices in Austria have augmented by almost a third since then, while demand has only decreased by a few percentage points. Looking at the RevPAR chart, it can be seen that it has mostly increased in the analyzed companies. In terms of total revenue, this suggests that price increases in Austria have so far only resulted in insignificant loss of demand and yet lead to an increase in revenue.

SHARE

Subscribe to our newsletter

Sign up now and receive monthly hotel and revenue management insights.